Accounting, financial closing and tax management

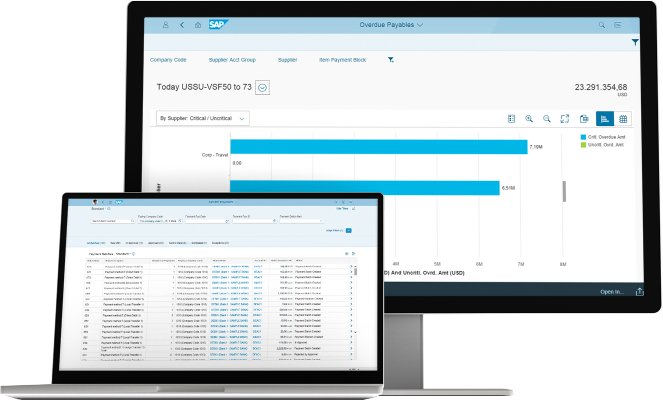

SAP S/4HANA Finance

Our decisions allow to accelerate the processes of financial account and creation of reports in real time. Formed only presentation of all financial data, and they can quickly receive analytical information, without waiting for the closure of the next month.

- Local deployment

- Universal magazine for financial and administrative data

- Observance of accounting standards

- Aggregating “on the fly”

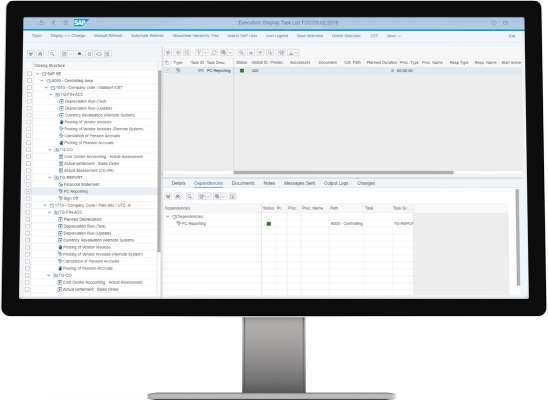

Dashboard SAP Financial Closing

Automation of processes of the financial closing, simplification of operations of audit and observance of standards of the financial reporting, such as GAAP. A single, intuitively clear user interface simplifies joint work of accounting professionals.

- Local, cloud or hybrid deployment options

- Centralized monitoring and control

- Process on the basis of templates

- Collaboration Tools

SAP Tax Compliance

The decision of SAP Tax Compliance allows to simplify your tax management approach and to avoid fines. Integrate the large volumes of transactions from the different systems, promoting exactness of the taxes given for a calculation. Automate compliance checks for sales taxes, VAT, goods and services tax and other taxes. Quickly expose and settle problems and carry out complete public accountant control.

- Local deployment

- Verification of transactions

- Automatic application of correcting measures

- Observance of normative requirements to the indirect taxes

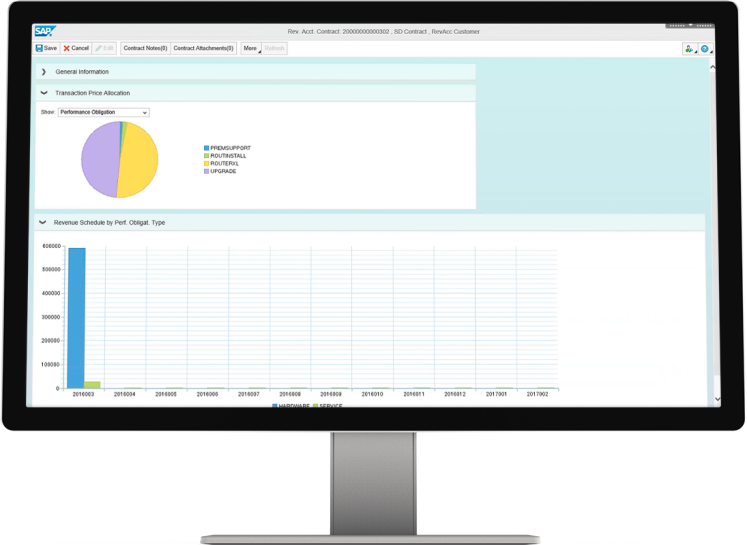

SAP Revenue Accounting and Reporting

Observance of new legislative requirements to confession of acuestss, such as MSFО 15, and existent standards. Treatment of orders, accounts and events from a few systems of SAP and strange producers. Increase of flexibility due to dissociating of rules of confession of acuestss from the systems of input of orders and billing.

- Local deployment

- Consolidation of orders, accounts and events

- Observance of normative requirements

- Simple processes